Ma payroll tax calculator

Ad Process Payroll Faster Easier With ADP Payroll. Any additional withholding amounts requested on the Massachusetts Employees Withholding Exemption Certificate Form M-4.

Payroll Software Solution For Massachusetts Small Business

The standard FUTA tax rate is 6 so your.

. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Your household income location filing status and number of personal. Subtract 12900 for Married otherwise.

Calculate your Massachusetts net pay or take home pay by entering your pay information W4 and Massachusetts state W4 information. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. This income tax calculator can help estimate your average.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. In 2022 if you are a new non-construction business you will.

You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223. This free user friendly payroll calculator will certainly calculate. Paycheck Results is your.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years Top 5 Free Payroll Software.

Free Unbiased Reviews Top Picks. Below are your Massachusetts salary paycheck results. Get Started With ADP Payroll.

Ad Compare This Years Top 5 Free Payroll Software. 2020 Federal income tax withholding calculation. Figure out how much each employee earned.

Get Started With ADP Payroll. Rates for 20220 are between 094 and 1437 depending on your claims history. Ad Process Payroll Faster Easier With ADP Payroll.

Massachusetts Hourly Paycheck Calculator Results. Rates are generally determined by legislation. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income.

Just enter the wages tax withholdings and other information. The results are broken up into three sections. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

Pay your employees by subtracting taxes and any other. Calculate taxes youll need to withhold and additional taxes youll owe. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Massachusetts Hourly Paycheck Calculator. Our quick payroll calculator will help you physique out the federal payroll tax withholding for both your staff and your company. Calculate withholding either by using the.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Our calculator has recently been updated to include both the latest.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Free Unbiased Reviews Top Picks. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

Tax Calculator For Wages Store 52 Off Www Ingeniovirtual Com

How To Calculate Taxes On Payroll Outlet 58 Off Www Ingeniovirtual Com

How To Calculate Massachusetts Income Tax Withholdings

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

How To Calculate Massachusetts Income Tax Withholdings

How To Calculate Payroll Taxes Methods Examples More

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

Massachusetts Salary Calculator 2022 Icalculator

How To Calculate Massachusetts Income Tax Withholdings

Payroll Tax Calculator For Employers Gusto

Massachusetts Paycheck Calculator Smartasset

Massachusetts Paycheck Calculator Smartasset

Excel Formula Income Tax Bracket Calculation Exceljet

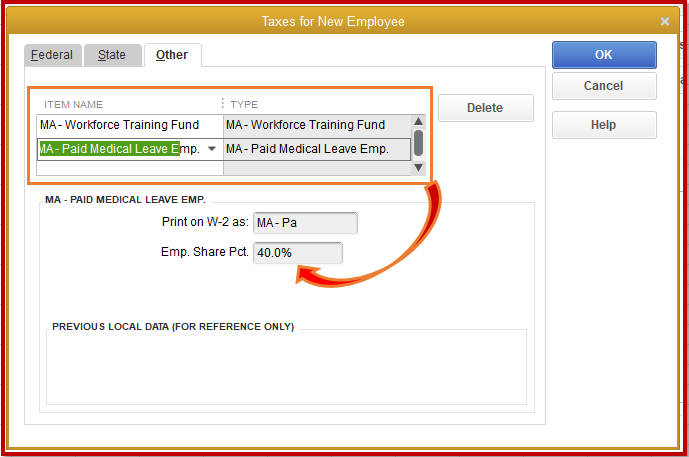

Massachusetts Paid Family Leave Not Calculating Correctly

How To Calculate Taxes On Payroll Outlet 58 Off Www Ingeniovirtual Com

Tax Calculator For Wages Store 52 Off Www Ingeniovirtual Com

Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay